Federal Government Defends Application for Fresh Loans Despite Revenue Surplus

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has stated that the Nigerian government must continue borrowing to fund its budget, despite some Ministries, Departments, and Agencies (MDAs) surpassing their revenue targets.

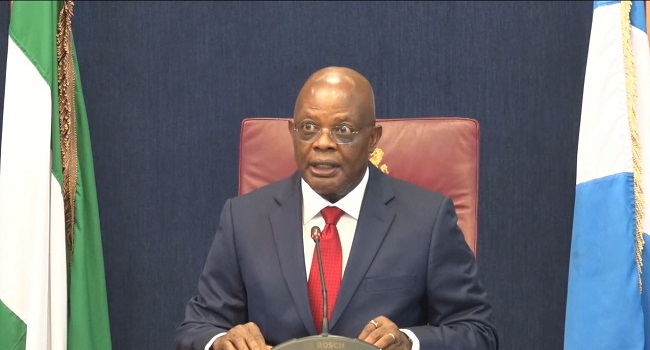

Edun made this assertion during an interactive session with the Senate Joint Committees on Finance, National Planning, and Economic Affairs on the 2025-2027 Medium-Term Expenditure Framework and Fiscal Strategy Paper.

According to him, while the government has made commendable strides in revenue generation, borrowing remains necessary to address critical funding needs.

“The revenue effort has been encouraging, but we still need to do better. In the meantime, borrowing must be productive, efficient, and sustainable to invest in the Nigerian economy. This includes not only infrastructure but also social services such as healthcare, education, and social safety nets for the most vulnerable,” he said.

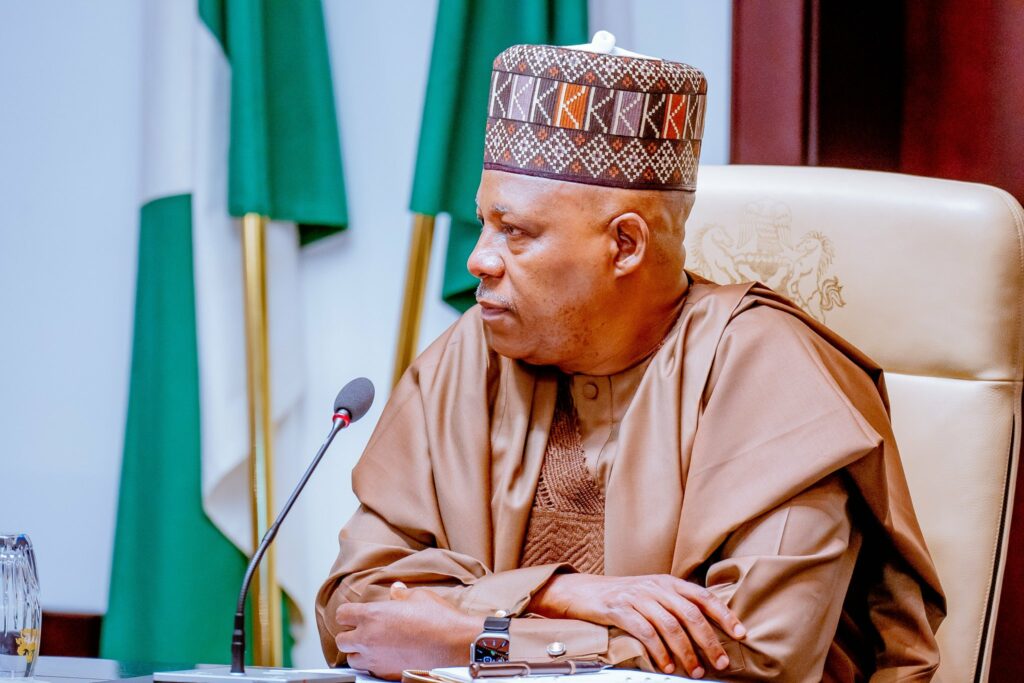

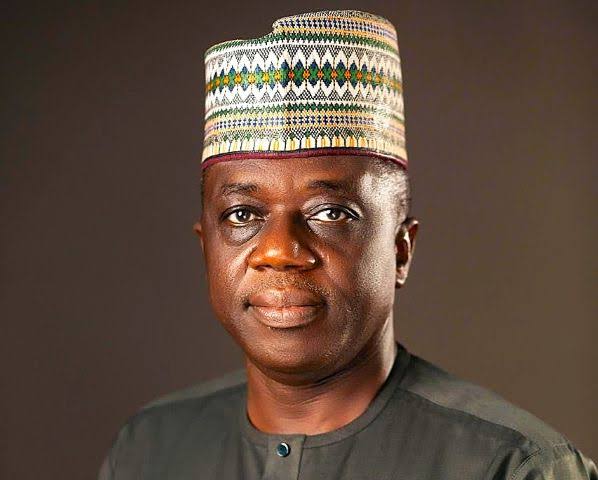

Similarly, the Minister of Budget and Economic Planning, Senator Atiku Bagudu, justified the borrowing plans embedded in the ₦35.5 trillion 2024 budget, which includes a ₦9.7 trillion deficit.

“Despite revenue targets being exceeded by some MDAs, the government still requires borrowing to address the deficit and enhance productivity, particularly for the poorest and most vulnerable Nigerians. We have a long-term development perspective with Agenda 2050, aiming for a GDP per capita of $33,000,” Bagudu said.

At the session, representatives of revenue-generating agencies detailed their successes in exceeding their targets for the 2024 fiscal year.

- Nigeria Customs Service (NCS): Comptroller-General Bashir Adeniyi disclosed that the service had collected ₦5.352 trillion in revenue as of September, surpassing its ₦5.09 trillion target for the year. A revenue target of ₦6.3 trillion is projected for 2025, with incremental increases for 2026 and 2027.

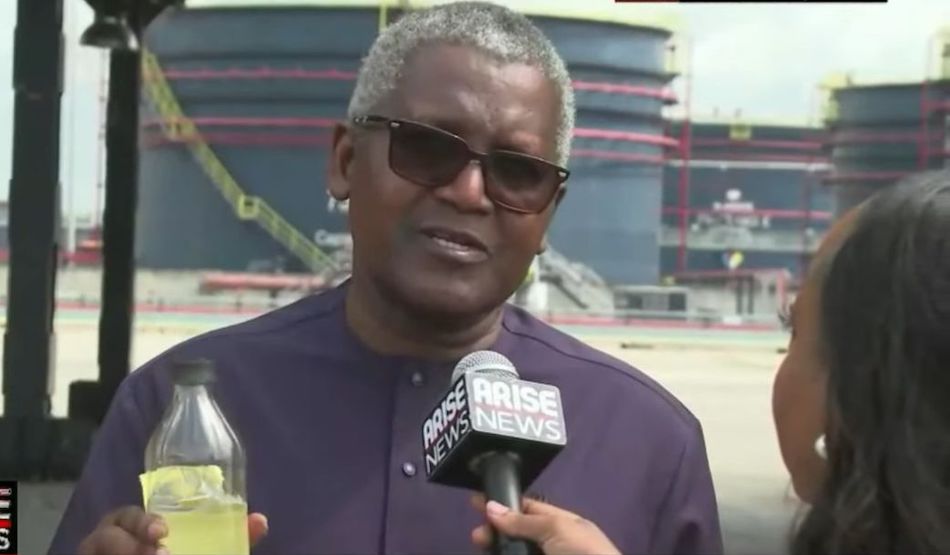

- Nigerian National Petroleum Company Limited (NNPCL): Group Chief Executive Officer Mele Kyari reported that the company had already exceeded its ₦12.3 trillion revenue projection for 2024 by generating ₦13.1 trillion. NNPCL aims to remit ₦23.7 trillion to the Federation Account in 2025.

- Federal Inland Revenue Service (FIRS): Chairman Zacchaeus Adedeji revealed that the agency had surpassed its targets across several tax categories, including ₦5.7 trillion in corporate income tax, exceeding the ₦4 trillion target. Total revenue as of September stood at ₦18.5 trillion, with projections to exceed ₦19.4 trillion by year-end.

The Economic and Financial Crimes Commission (EFCC) also reported recovering over ₦197 billion in 2024. Chairman Ola Olukoyede argued that improved revenue collection, particularly from International Oil Companies (IOCs), could significantly reduce the need for borrowing.

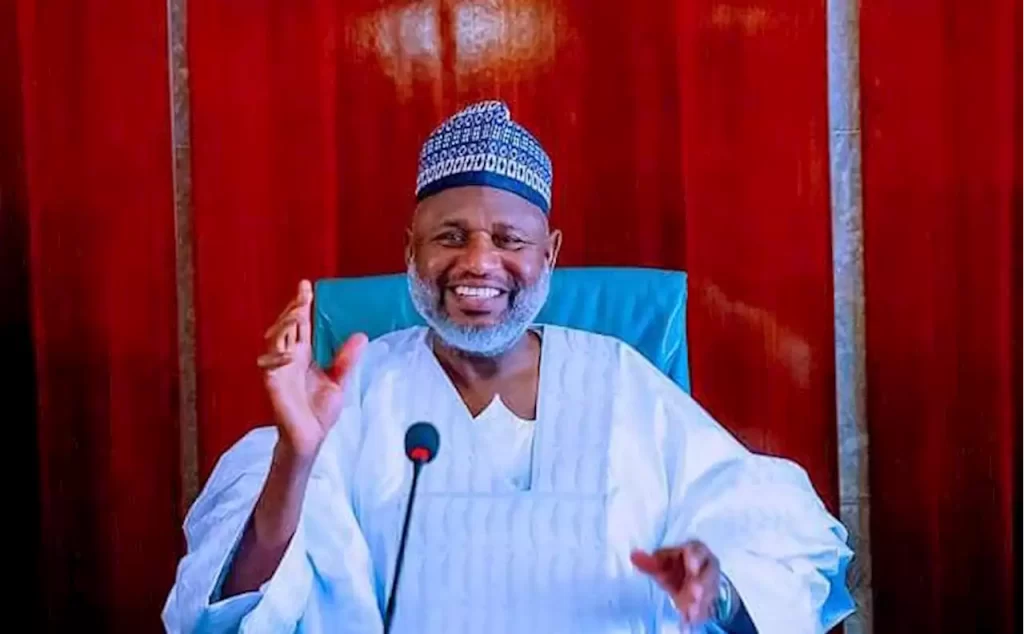

On Thursday, the Senate, presided over by Deputy Senate President Barau Jibrin, approved President Bola Tinubu’s request to borrow ₦1.77 trillion ($2.2 billion) to partially fund the 2024 budget deficit. The approval followed a report by the Senate Committee on Local and Foreign Debts, chaired by Senator Wammako Magatarkada.

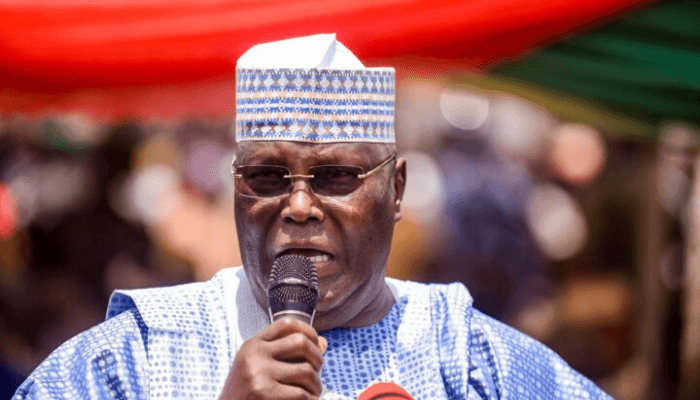

The request, however, sparked criticism from opposition figures, including former Vice President Atiku Abubakar, who described it as burdensome.

“These loans are bone-crushing for Nigerians, creating insufferable pressure on the economy, especially when not properly negotiated or utilised,” Atiku wrote on X (formerly Twitter). He accused the government of pursuing loans driven by corruption rather than developmental needs and criticised the National Assembly for being complicit.