FG Insists Naira-for-Crude Policy Still Active, Defies NNPCL’s Expiry Claim

The Federal Government has reiterated that its Naira-for-crude oil initiative remains in force and is a long-term policy, not a temporary arrangement. The move is aimed at fostering sustainable local refining and reducing the country’s reliance on foreign exchange in the oil sector.

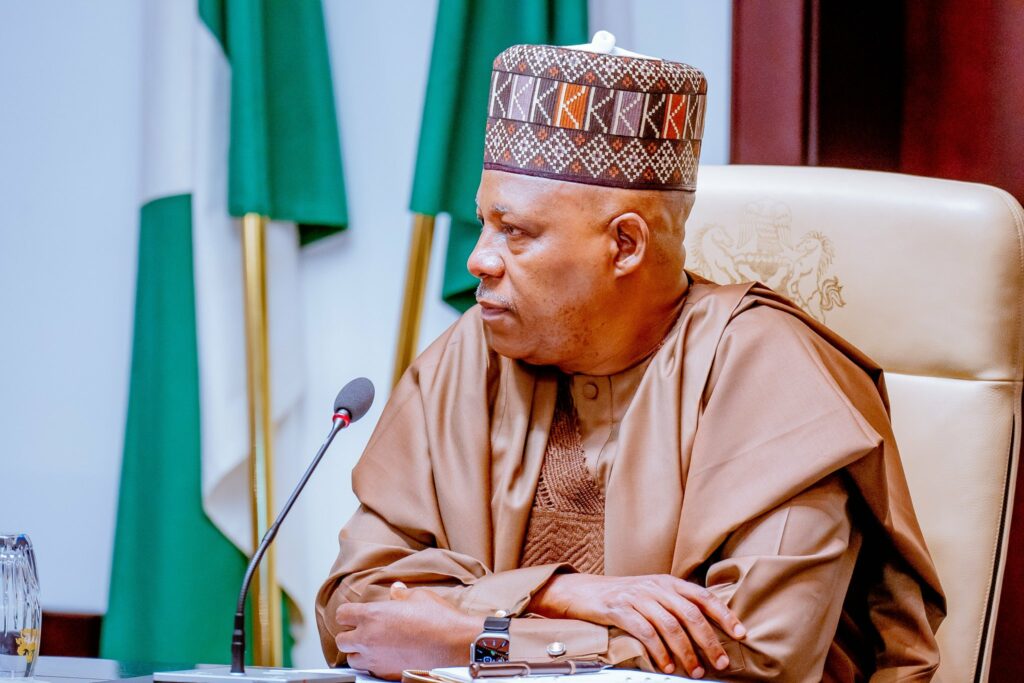

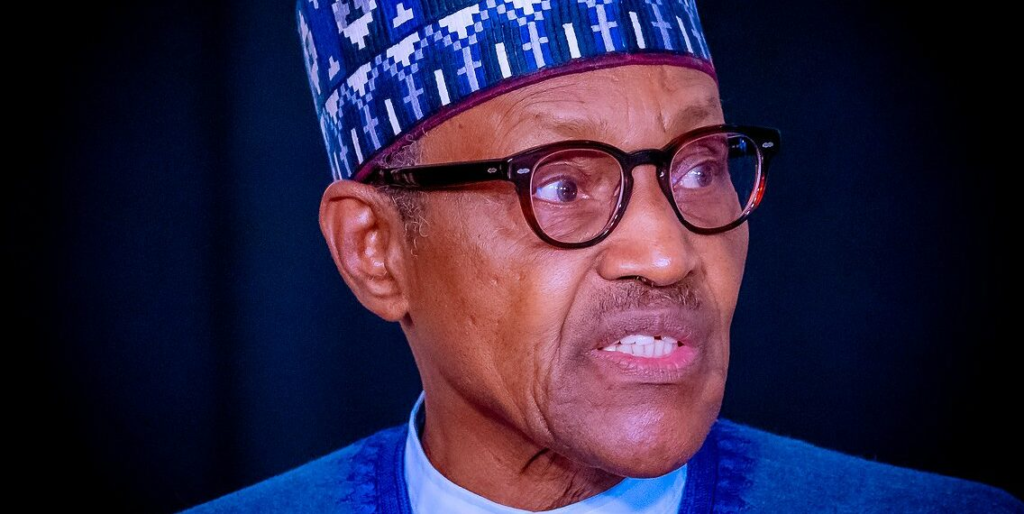

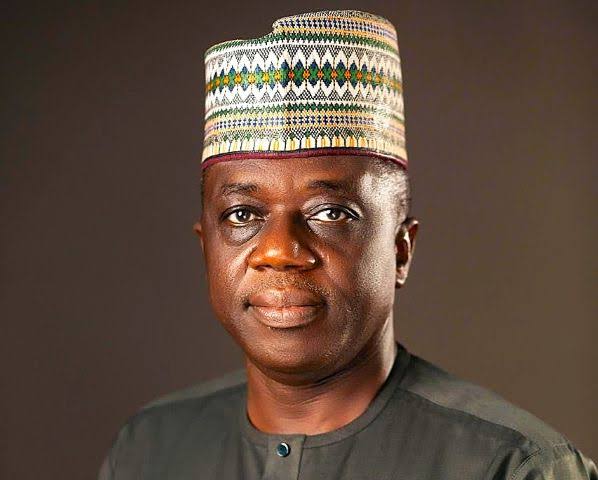

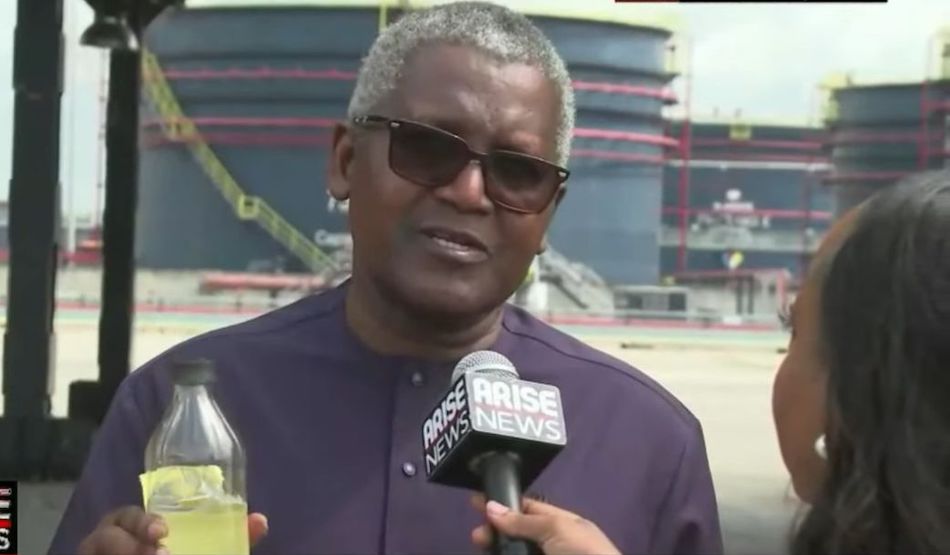

This clarification comes amid reports suggesting the Nigerian National Petroleum Company Limited (NNPCL), under its former Group CEO Mele Kyari, had suspended the initiative.

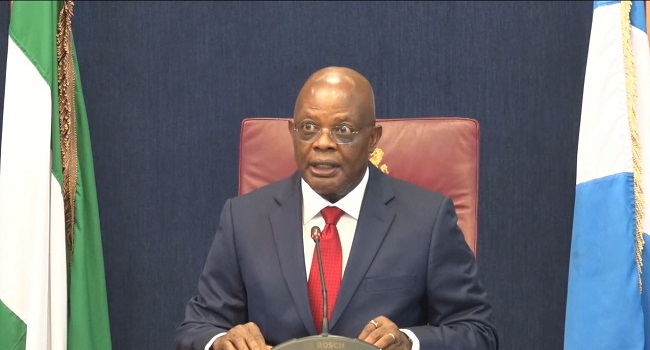

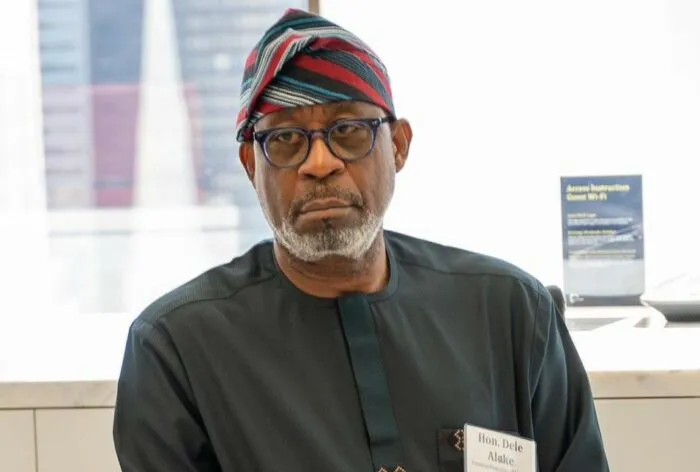

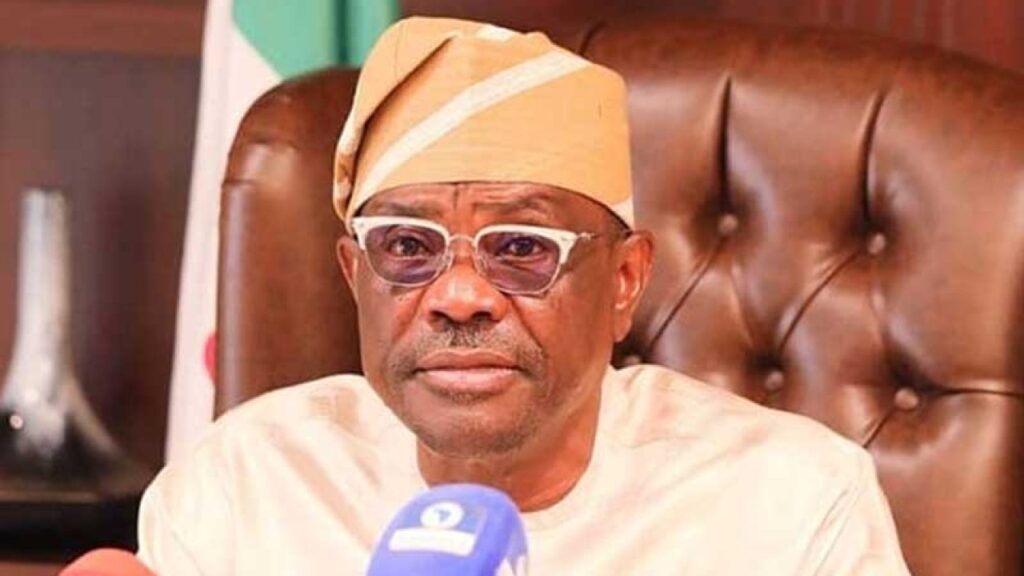

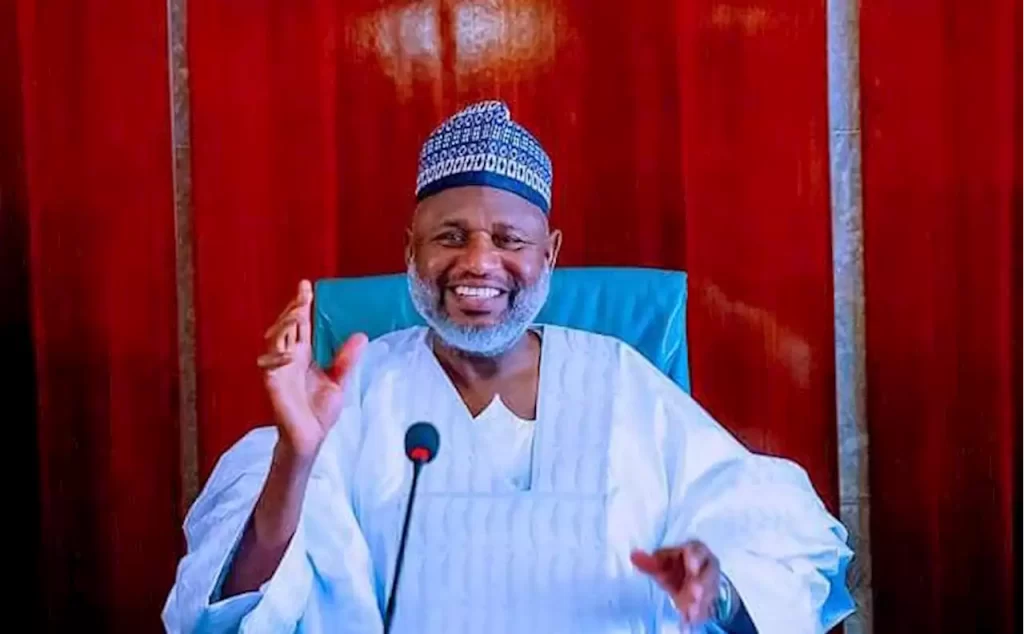

At a meeting held on Tuesday with representatives of the Dangote Refinery, the Minister of Finance, Wale Edun, confirmed that the Naira-for-crude framework is still operational.

In a statement posted on its official X handle on Wednesday, the Ministry of Finance disclosed that the Technical Sub-Committee on the Crude and Refined Product Sales in Naira initiative convened to review progress and address implementation issues.

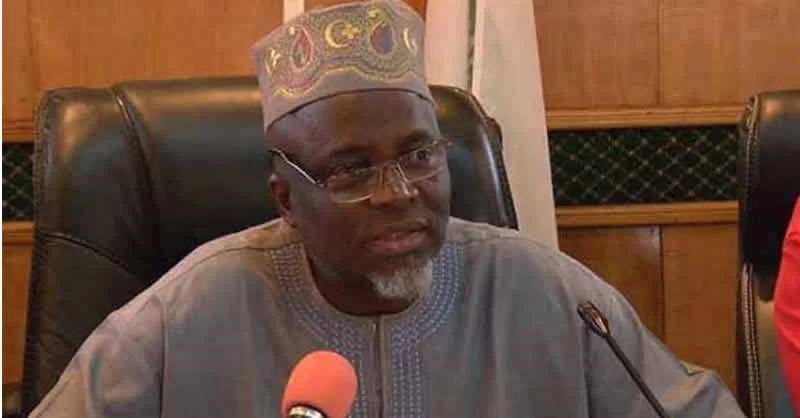

The meeting was chaired by Edun and attended by the Chairman of the Technical Sub-Committee and Executive Chairman of the Federal Inland Revenue Service (FIRS), Zacch Adedeji, alongside senior executives from NNPCL, including Chief Financial Officer Dapo Segun, the Coordinator of NNPC Refineries, and the management of NNPC Trading.

RELATED STORY: NNPC Still Open to Crude Supply in Naira to Dangote Refinery, Others

Other attendees included representatives from the Dangote Petroleum Refinery and Petrochemicals, the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), the Central Bank of Nigeria (CBN), the Nigerian Ports Authority (NPA), Afreximbank, and Committee Secretary Hauwa Ibrahim.

“The stakeholders reaffirmed the government’s unwavering commitment to the full implementation of this strategic initiative, as mandated by the Federal Executive Council (FEC),” the ministry stated.

“This is not a time-bound intervention, but a key policy directive aimed at enhancing local refining capacity, ensuring energy security, and easing pressure on the nation’s foreign reserves.”

The committee acknowledged that, like all major policy shifts, challenges may arise, but noted that these are being actively addressed through a coordinated, multi-stakeholder approach.

The policy, introduced by the FEC in July 2024, directed the NNPCL to sell crude oil to the Dangote Refinery and other local processors in Naira to mitigate pressure on the US dollar and stabilise fuel prices.

However, in March 2025, the NNPCL announced that the initial Naira-denominated crude sales agreement was structured to run for six months, expiring that same month. Consequently, the Dangote Refinery suspended its sale of refined products in Naira, citing a mismatch between its dollar-denominated crude purchases and Naira-based product sales.