UBA Unveils Next-Gen PoS, Upgraded MONI App to Boost SME Banking

United Bank for Africa (UBA) Plc has unveiled a significantly enhanced Point of Sale (PoS) terminal and an upgraded MONI App as part of its broader campaign to support small and medium-sized enterprises (SMEs) and drive digital payments across Africa.

Themed Innovation for Progress: Empowering SMEs, Connecting Communities, Simplifying Banking, the initiative aims to strengthen financial inclusion and modernise business operations across the continent.

The newly upgraded PoS terminal boasts several innovative features, including instant settlement, real-time transaction monitoring, pay-by-link functionality, and a 100% transaction success rate, offering merchants greater transparency and efficiency.

Designed to serve businesses of all sizes, the terminal offers speed and reliability tailored to the demands of today’s fast-paced commercial environment.

The revamped MONI App, which supports UBA’s growing agency banking network, now includes instant settlement, pay-by-transfer functionality, secret question security, a redesigned homepage, and an enhanced inbox—making it more intuitive and secure for both agents and customers.

These upgrades complement the app’s core features, which include instant account opening with BVN/NIN, real-time fund transfers, cash deposits and withdrawals, airtime and data purchases with agent discounts, and instant PoS deployment.

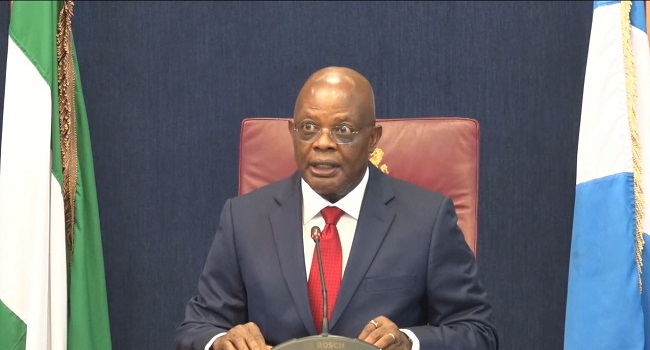

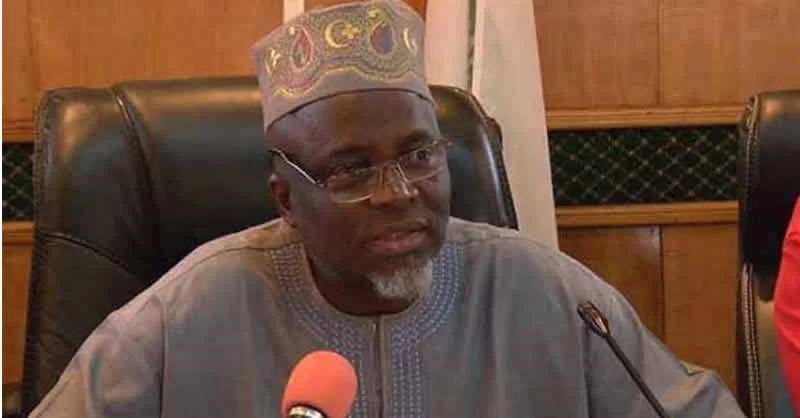

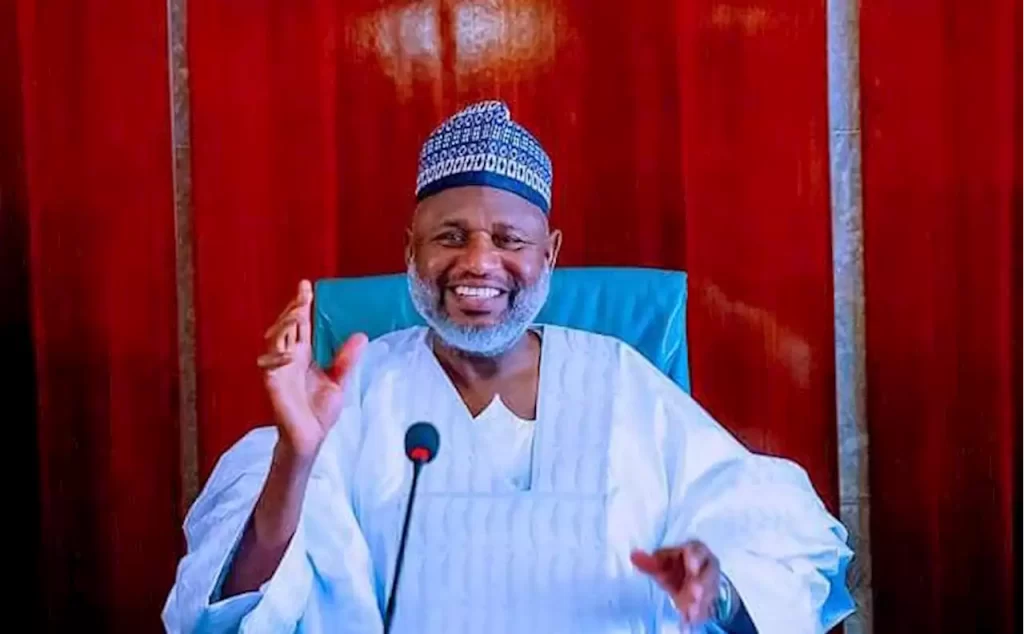

Speaking on the development, UBA’s Group Head of Retail and Digital Banking, Shamsideen Fashola, emphasised the bank’s commitment to innovation and customer satisfaction.

“At UBA, we are constantly innovating to provide seamless and secure payment solutions for businesses of all sizes,” he said. “The new PoS and MONI App empower merchants and agents with instant settlements, real-time tracking, and unmatched reliability.”

He added: “This next-generation PoS device is more than a payment tool; it’s a business enabler. With our vast reach and infrastructure, we are delivering convenience and confidence with every transaction.

“Through the upgraded MONI App, we are equipping our agents—especially those in underserved communities—with the tools they need to expand their services and grow their businesses.”