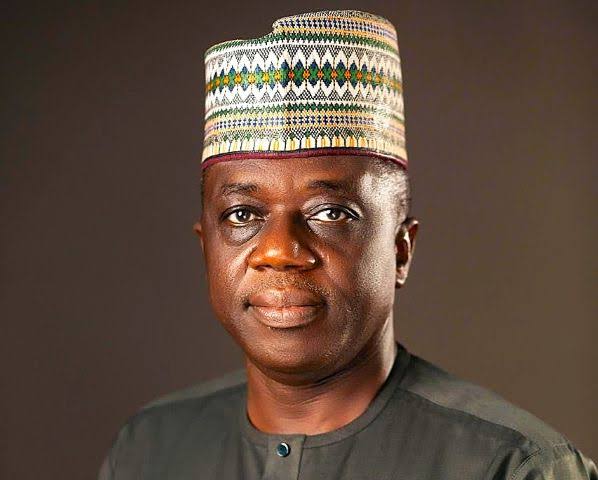

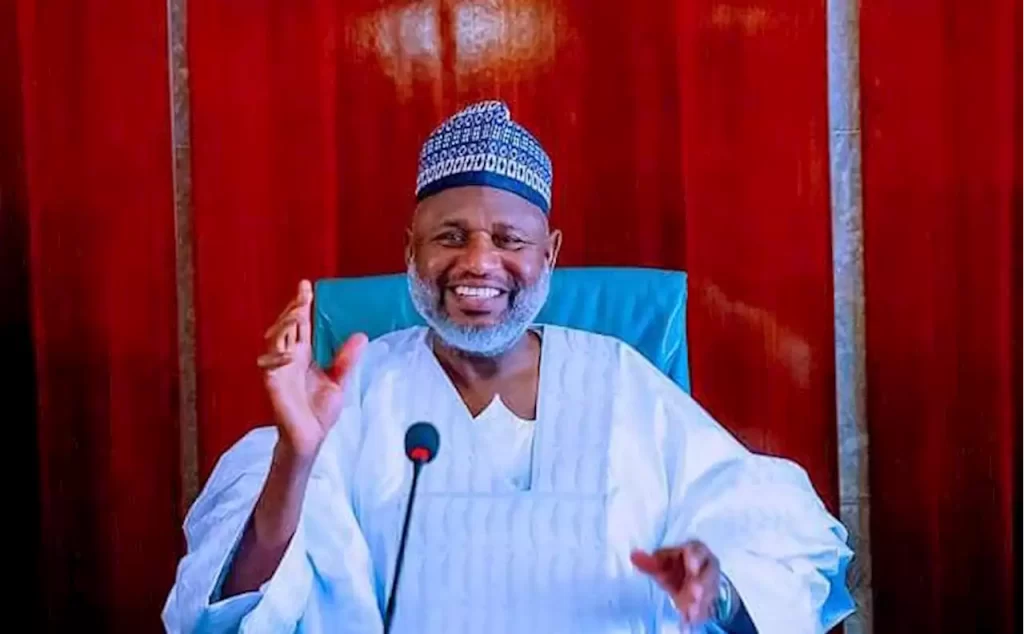

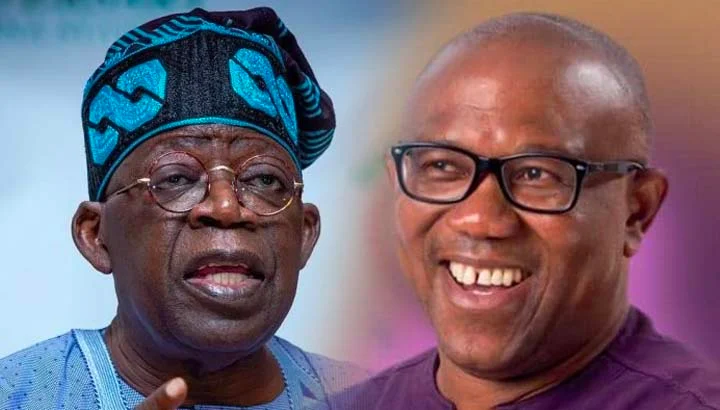

Landmark Tax Bills: Tinubu Prepares to Sign Sweeping Reforms

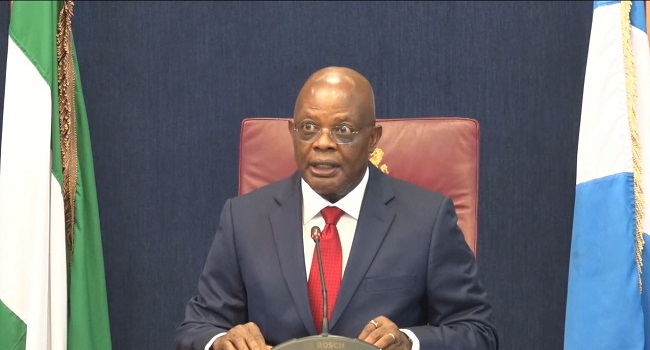

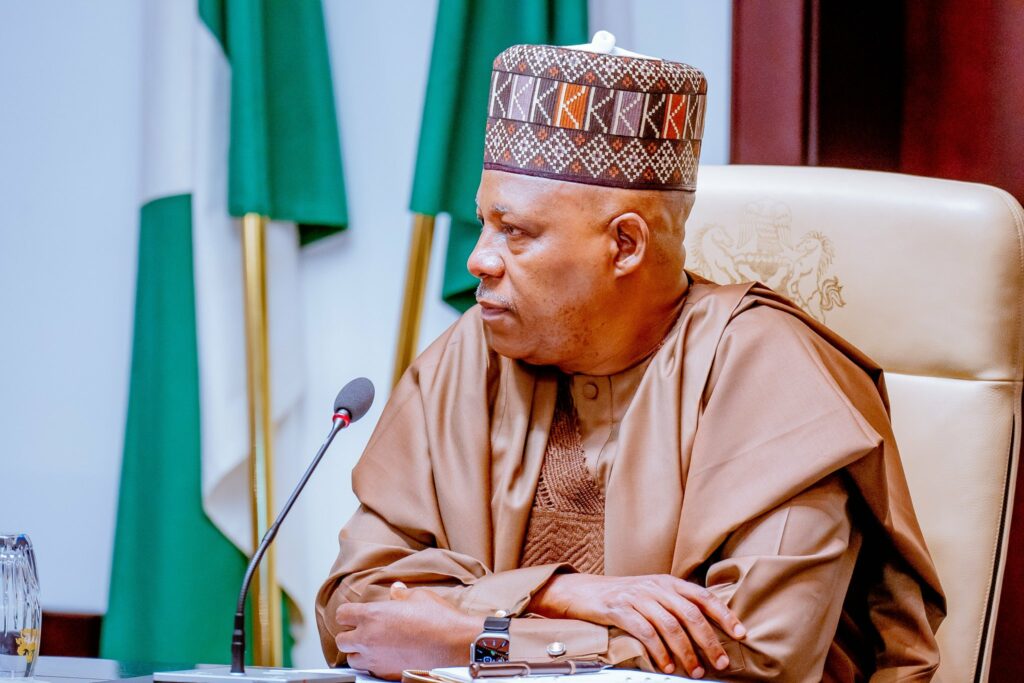

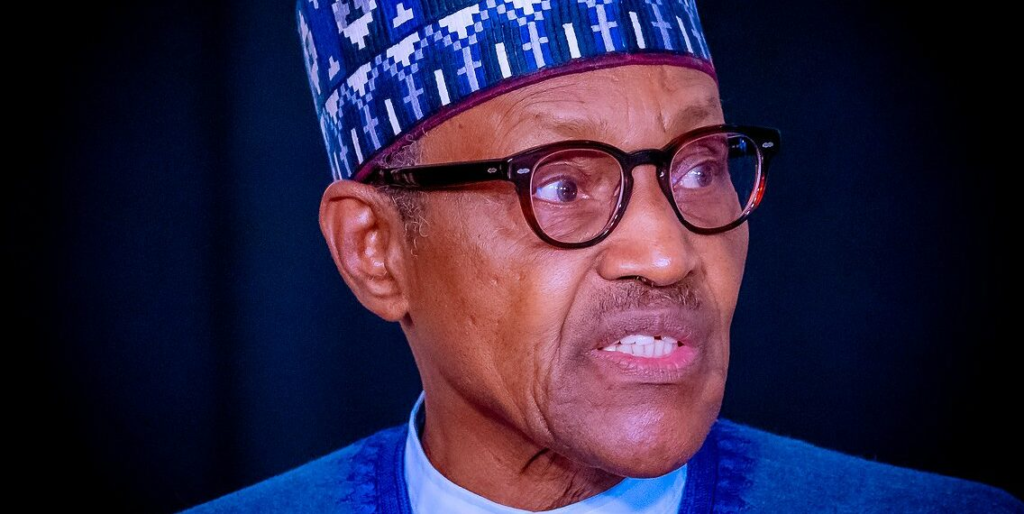

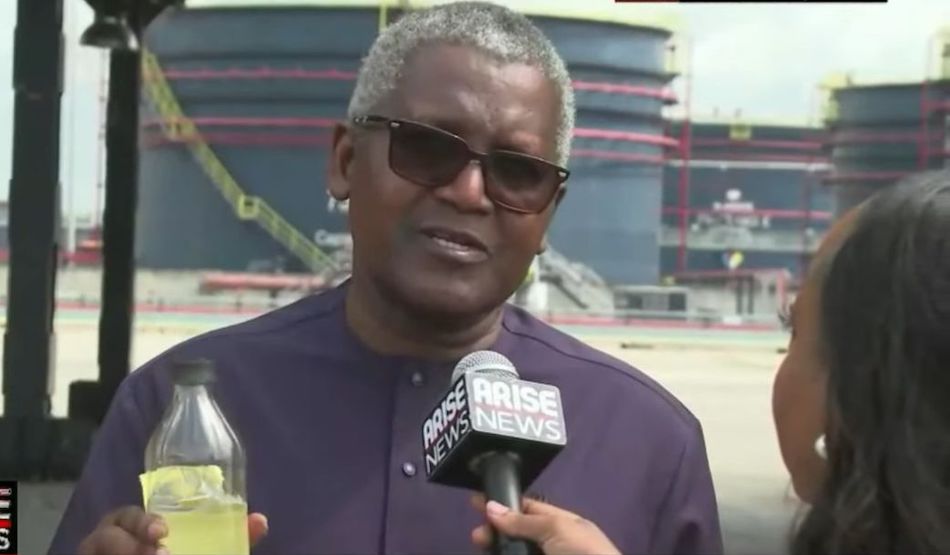

President Bola Tinubu is set to sign into law four far-reaching tax reform bills on Thursday, a move expected to significantly overhaul Nigeria’s fiscal and revenue systems.

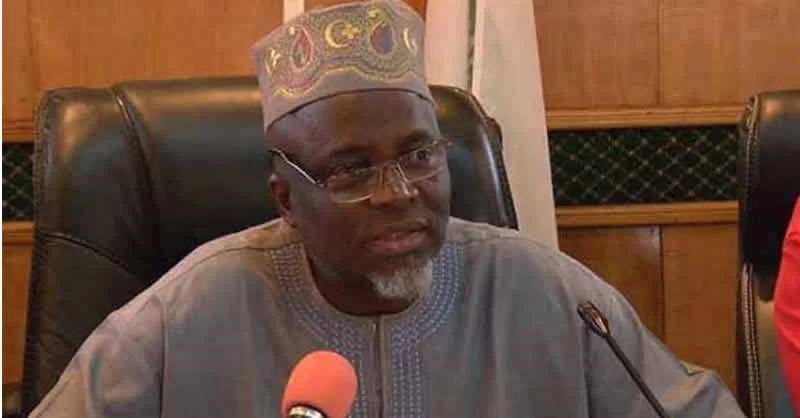

The bills — the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill — were passed by the National Assembly following extensive consultations with stakeholders.

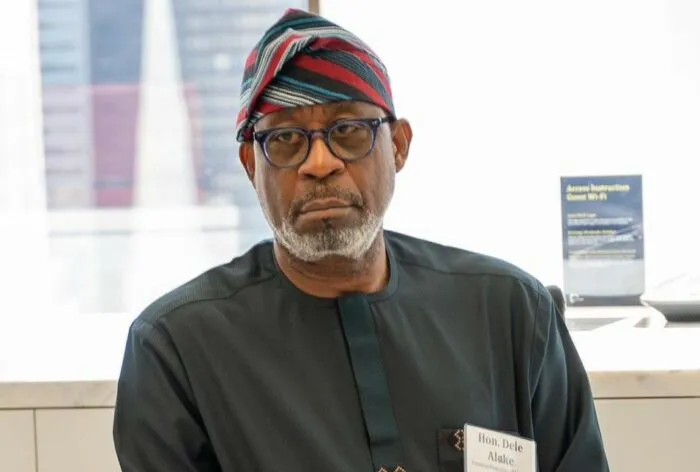

A statement by presidential spokesperson Bayo Onanuga confirmed that the signing ceremony will take place at the Presidential Villa in Abuja. Attendees will include the Senate President, the Speaker of the House of Representatives, majority leaders of both chambers, and the finance committee chairpersons.

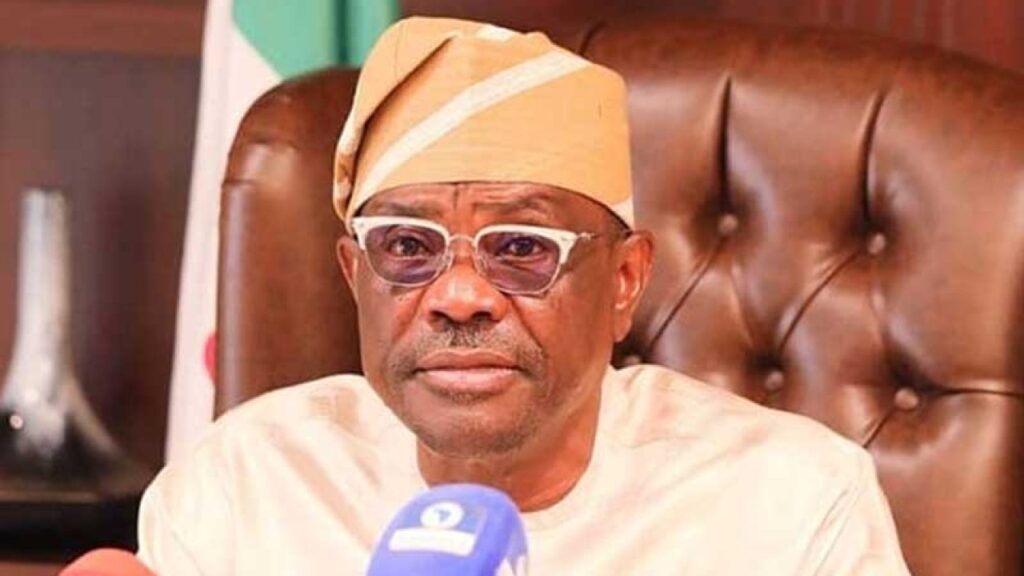

Also expected at the event are the Chairman of the Nigeria Governors’ Forum, the Chairman of the Progressives Governors Forum, the Minister of Finance and Coordinating Minister of the Economy, and the Attorney-General of the Federation.

Among the four bills, the Nigeria Tax Bill (Ease of Doing Business) aims to consolidate Nigeria’s fragmented tax laws into a single, harmonised statute. It seeks to reduce the number of taxes, eliminate duplication, and ease the compliance burden on businesses.

The Nigeria Tax Administration Bill provides a uniform legal and operational framework for tax administration at federal, state, and local government levels.

The Nigeria Revenue Service (Establishment) Bill repeals the current Federal Inland Revenue Service Act and establishes the Nigeria Revenue Service (NRS) — a more autonomous, performance-based agency with an expanded mandate that includes non-tax revenue collection. It also introduces new measures for transparency and accountability.

The fourth bill, the Joint Revenue Board (Establishment) Bill, sets up a formal governance framework to foster coordination among revenue agencies nationwide. It also proposes the creation of a Tax Appeal Tribunal and an Office of the Tax Ombudsman.

Once enacted, these reforms are expected to enhance revenue generation, improve the ease of doing business, and attract both local and foreign investment.