Debt or Development? Lawmakers Back Massive Borrowing to Fund Infrastructure, Pensions

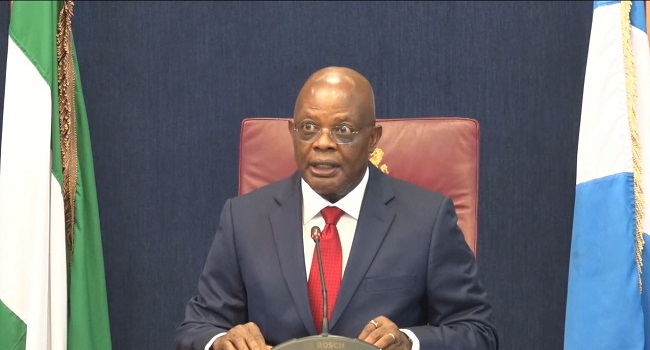

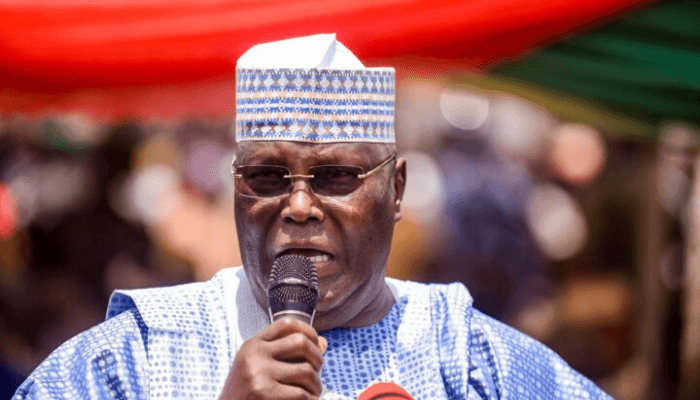

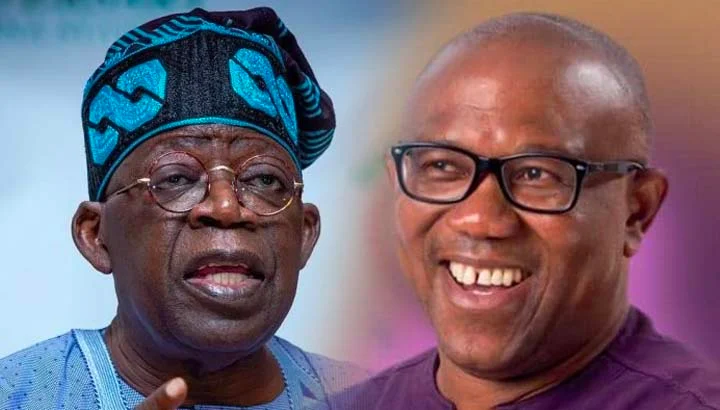

The Senate on Tuesday approved President Bola Tinubu’s comprehensive borrowing plan for the 2025–2026 fiscal period, including $21.5 billion in external loans, €2.2 billion, 15 billion Japanese Yen, and a €65 million grant.

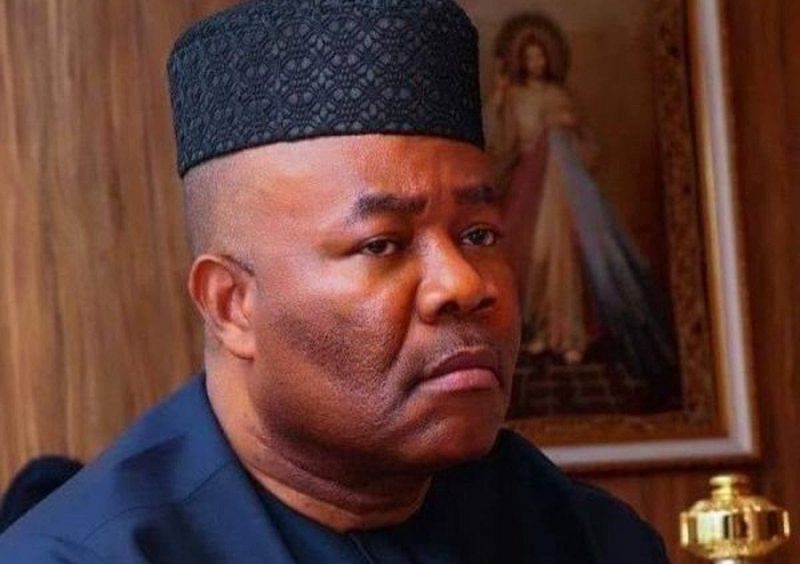

Also endorsed was a N757.98 billion domestic bond issuance aimed at clearing outstanding liabilities under the Contributory Pension Scheme (CPS), some dating back to December 2023.

The loans, part of Nigeria’s Medium-Term Expenditure Framework and Fiscal Strategy Paper, will support key sectors such as power, transport, health, and education.

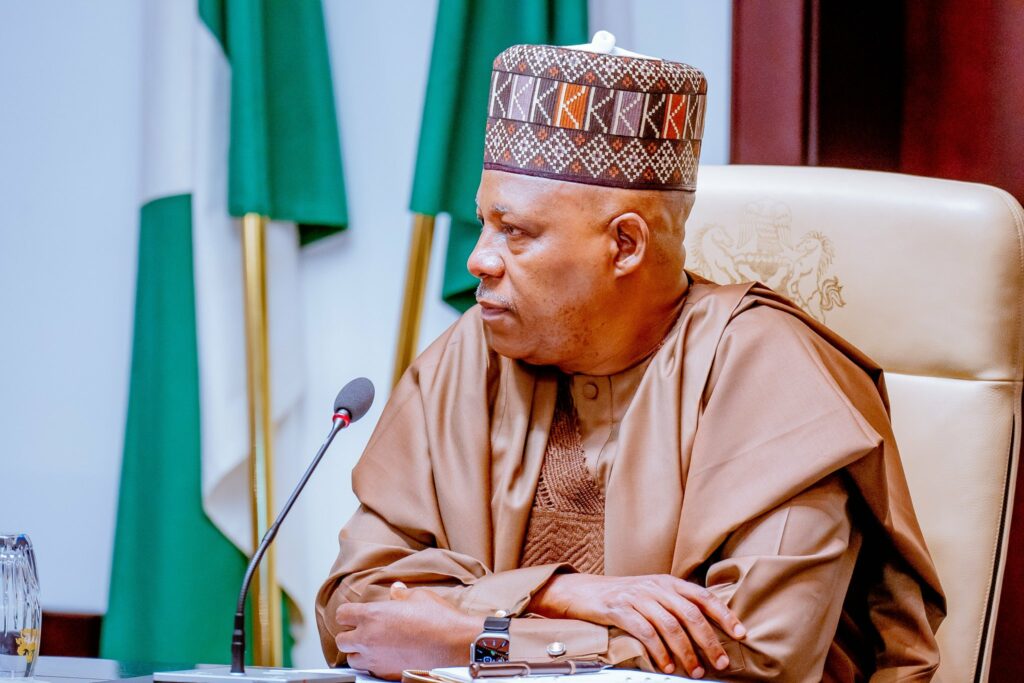

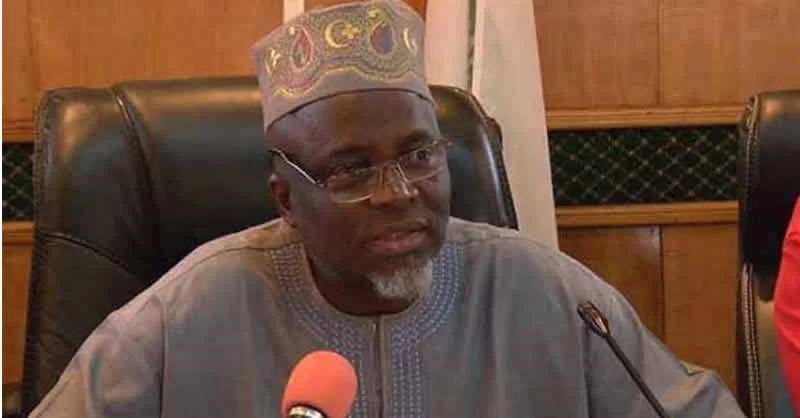

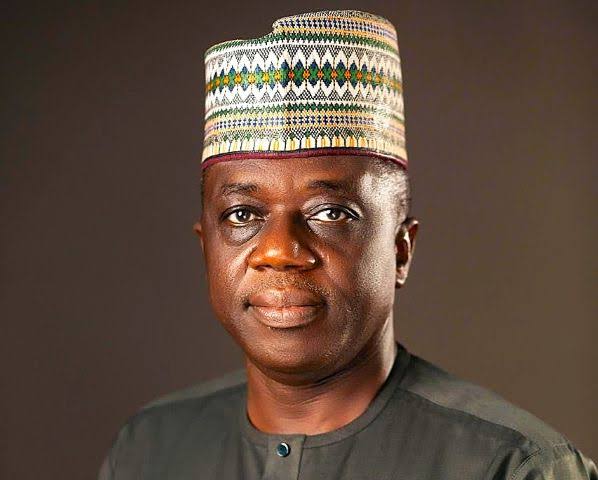

Senate Committee on Local and Foreign Debts Chair, Senator Aliyu Wamakko, said the loans were largely concessional, with low interest rates and long repayment periods.

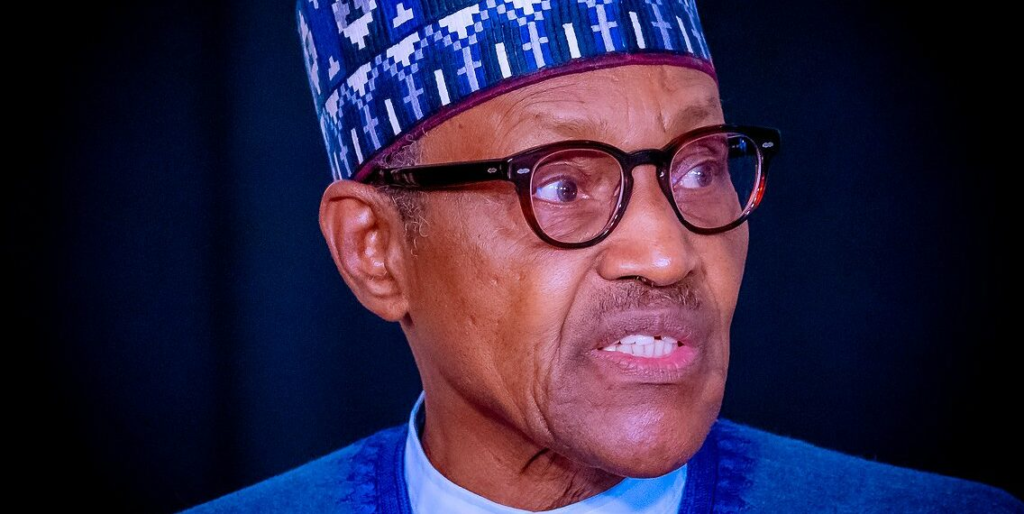

Tinubu described the borrowing as necessary to address Nigeria’s infrastructure deficit, worsened by declining revenues and the removal of fuel subsidies.

Notably, the Senate approved a $2 billion Foreign Currency Denominated Issuance Programme—enabled by Executive Order No. 16 of 2023—allowing the government to raise forex domestically, deepening local capital markets and easing pressure on reserves.

Funds will be earmarked for strategic projects in transportation, energy, and digital infrastructure.

The Senate also approved Tinubu’s request to issue N758 billion in bonds to settle pension arrears under the CPS, aligning with the Pension Reform Act of 2014.

This move aims to restore confidence in the pension system and alleviate hardship among retirees. Despite concerns over Nigeria’s rising debt, lawmakers argued that long-term benefits outweigh the short-term costs.