Zenith Bank Declares N1.25 Interim Dividend as Profit Before Tax Hits N625.6bn in H1 2025

Zenith Bank Plc has announced its Group financial results for the half year ending June 2025, reporting a profit before tax of N625.63 billion. In line with this strong performance, the Board approved an interim dividend of N1.25 per share—representing a 25 per cent increase on the N1.00 paid in the first half of 2024. This reinforces the bank’s reputation as a leading dividend-paying institution and underscores its consistent commitment to rewarding shareholders.

The payout reflects the bank’s exceptional underlying performance, despite higher provisioning requirements following the industry-wide withdrawal of the Central Bank of Nigeria’s (CBN) forbearance regime. Gross earnings rose 20 per cent year-on-year, climbing from N2.1 trillion in H1 2024 to N2.5 trillion in H1 2025. Interest income was the main driver, surging 60 per cent from N1.1 trillion to N1.8 trillion, largely due to strategic repricing of risk assets and prudent treasury management.

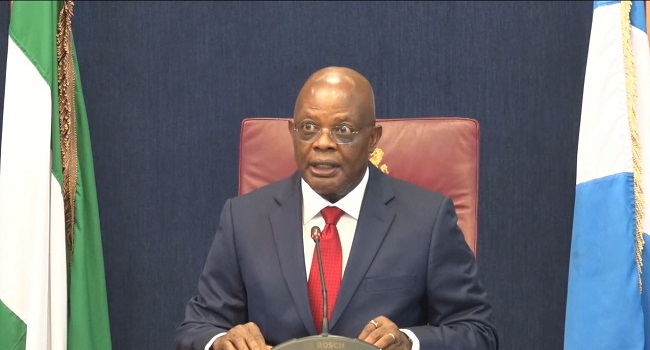

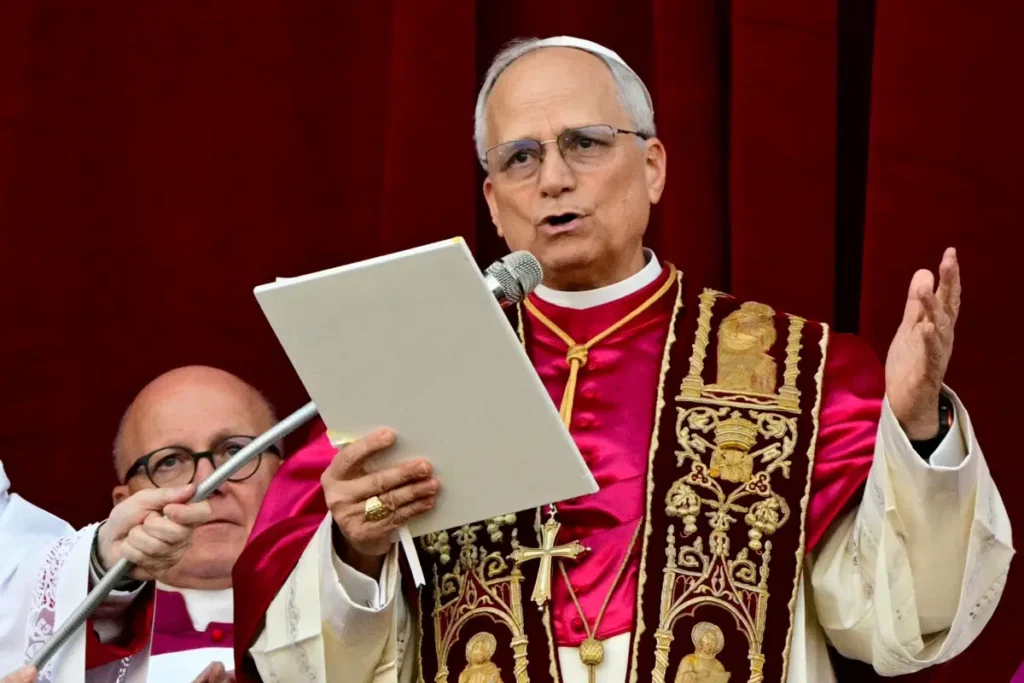

Commenting on the results, Group Managing Director/Chief Executive Officer, Dame Dr. Adaora Umeoji, OON, said the performance reflects the “creativity and innovation” of the bank’s workforce in a challenging operating environment.

“Despite significant provisioning requirements as the industry transitions from the CBN forbearance regime, we have recorded marked improvements in asset quality. Our balance sheet remains strong with adequate capital buffers, positioning us to seize opportunities across our markets,” she stated.

Looking ahead, Umeoji expressed optimism that the bank would accelerate its growth in the second half of the year, buoyed by stronger asset quality. She assured shareholders that Zenith remains on course to deliver “exceptional returns” and a significant year-end dividend.

“Our shareholders can expect sustained value creation as we continue to leverage opportunities and maintain our growth strategy under a culture of strong corporate governance,” she added.

For the period under review, profit after tax stood at N532 billion, while earnings per share rose to N12.95. Net interest income almost doubled, leaping 90 per cent year-on-year from N715 billion to N1.4 trillion. Non-interest income contributed N613 billion.

Total assets rose to N31 trillion in June 2025, up from N30 trillion in December 2024, underpinned by a solid balance sheet. Customer deposits grew 7 per cent to N23 trillion, compared with N22 trillion at the end of 2024. Loans, however, dipped from N11 trillion in December 2024 to N10.2 trillion in June 2025, reflecting the bank’s cautious risk management stance.

The bank posted strong returns, with Return on Average Equity (ROAE) at 24.8 per cent and Return on Average Assets (ROAA) at 3.5 per cent as of June 2025. Its cost-to-income ratio stood at 48.2 per cent, influenced by provisioning and inflationary pressures. Asset quality also improved, with the non-performing loan ratio falling to 3.1 per cent from 4.7 per cent in December 2024. Capital adequacy was reported at 26 per cent, while liquidity stood at 69 per cent—both comfortably above regulatory thresholds.

Zenith Bank’s consistent financial performance has won it multiple international and local awards. In 2025, it was ranked Nigeria’s number one bank by Tier-1 Capital in The Banker’s Top 1000 World Banks for the 16th consecutive year, and was named “Nigeria’s Best Bank” at the Euromoney Awards for Excellence. Other accolades include Bank of the Year (Nigeria) in The Banker’s awards (2020, 2022, 2024), Best Bank in Nigeria in the Global Finance Awards (2020–2022, 2024–2025), and Best Bank for Digital Solutions in Nigeria at the 2023 Euromoney Awards.

The bank has also been recognised for governance, sustainability, and innovation. Highlights include Best Corporate Governance Bank, Nigeria, in the World Finance Corporate Governance Awards (2022–2025), Most Sustainable Bank, Nigeria, at the International Banker Awards (2023–2024), and Most Responsible Organisation in Africa at the SERAS CSR Awards (2024).

Zenith has further been named Nigeria’s Most Valuable Banking Brand by The Banker’s Top 500 Banking Brands (2020–2021), Bank of the Year at the BusinessDay Banks and Other Financial Institutions Awards (2023–2024), and Best Commercial Bank and Best Innovation in Retail Banking in the 2022 International Banker Awards.

In 2025, the bank’s Hybrid Offer was adjudged “Rights Issue/Public Offer of the Year” at the Nairametrics Capital Market Choice Awards, further cementing its leadership in the Nigerian banking sector.