FG introduces progressive Capital Gains Tax to boost investor confidence

The Presidential Committee on Fiscal Policy and Tax Reforms has announced a new Capital Gains Tax (CGT) regime on shares, aimed at reducing business risks, bolstering investor confidence, and creating a fairer tax system.

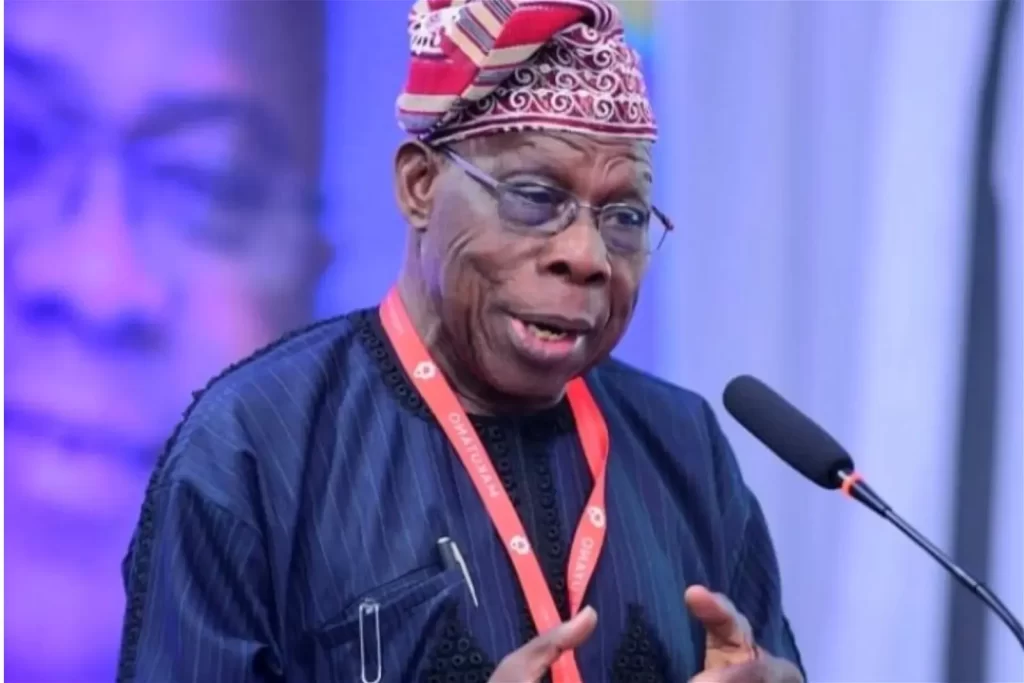

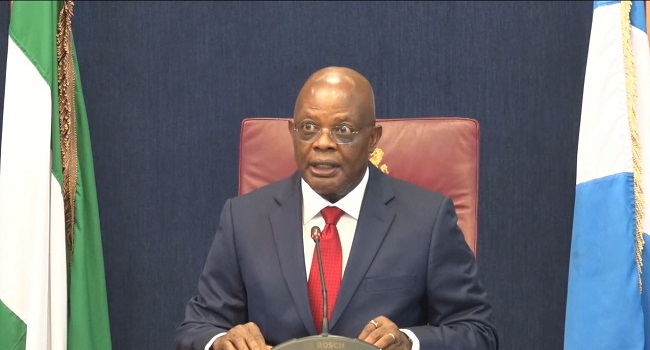

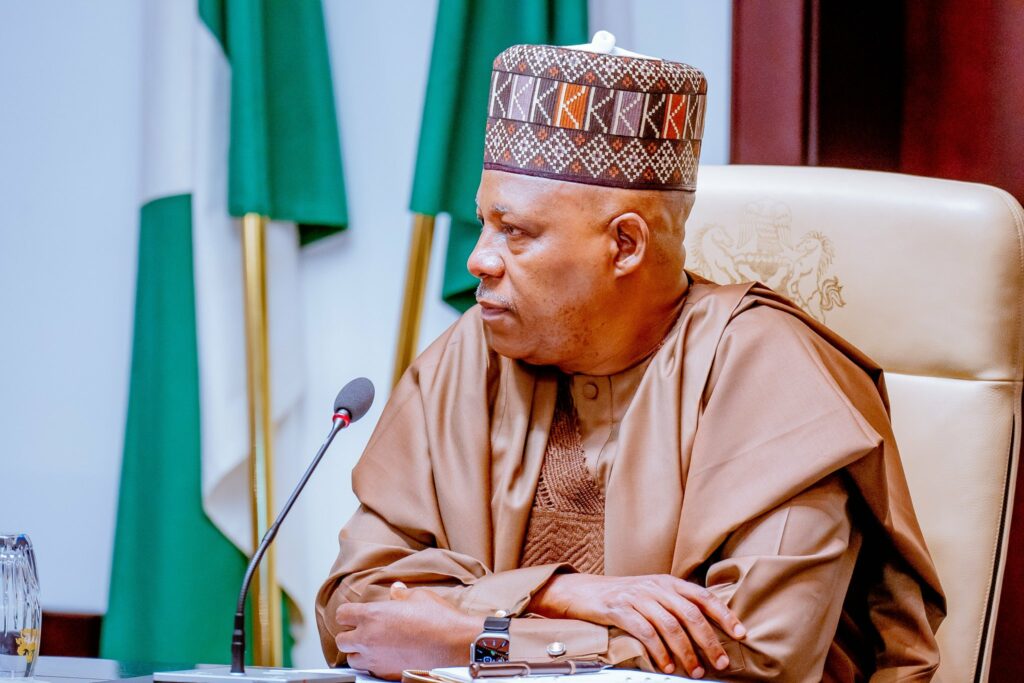

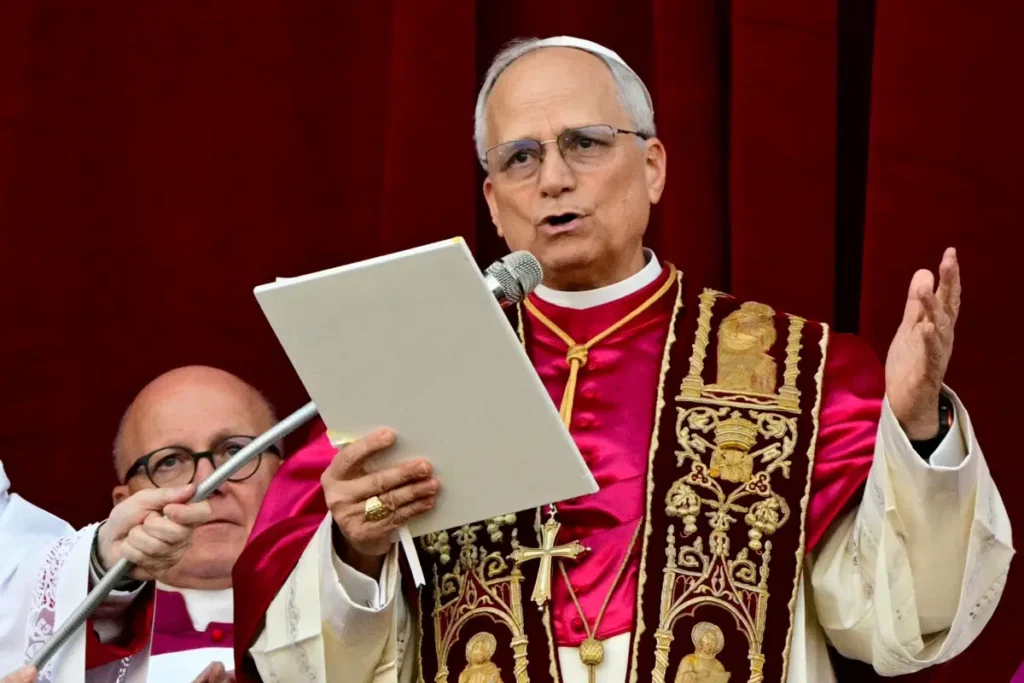

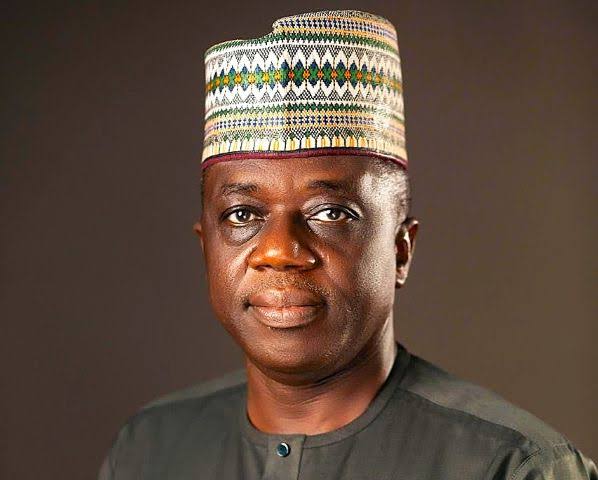

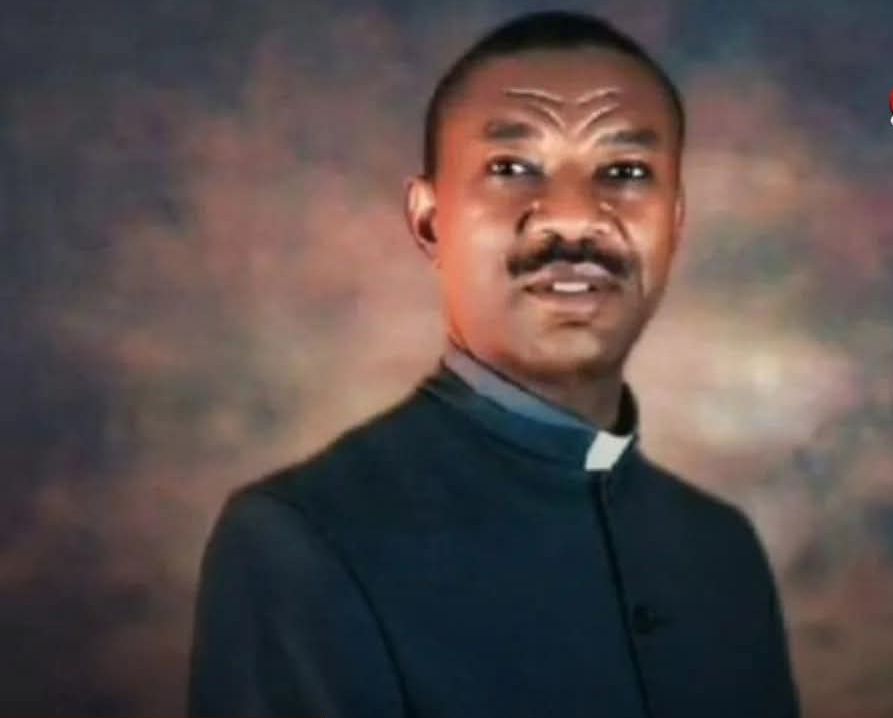

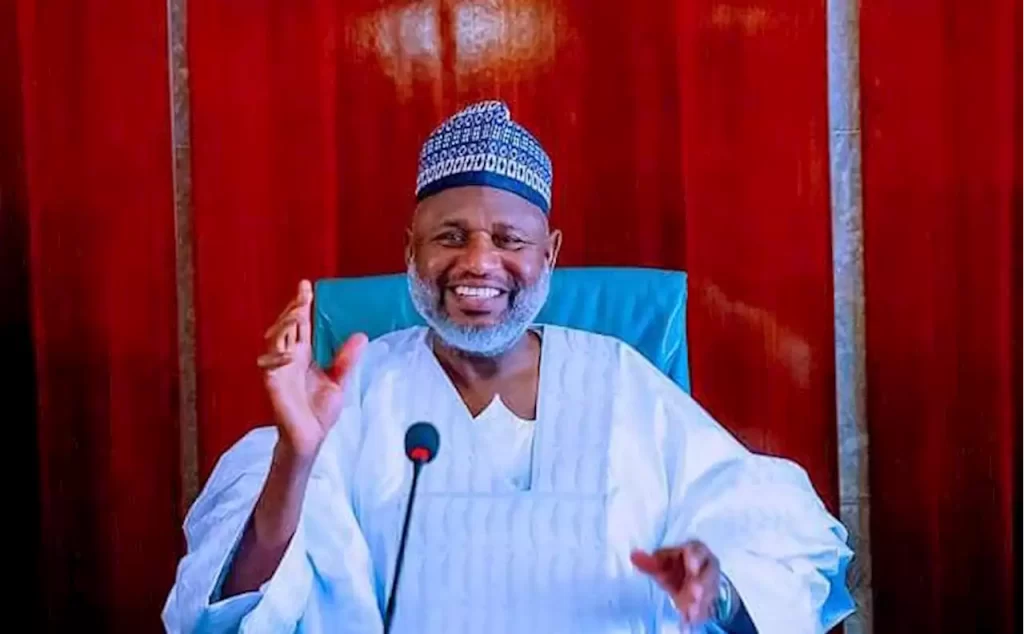

The committee’s chairman, Mr. Taiwo Oyedele, disclosed this during a virtual market engagement with the Nigerian Exchange Group (NGX) on capital gains tax.

He explained that the reforms were designed to lower entry costs for start-ups, improve cash flow for businesses, and safeguard Nigeria’s tax base, while simplifying compliance for individuals and companies.

“Under the old regime, capital gains on shares were taxed at a flat rate of 10 per cent, with no relief for capital losses and very limited exemptions.

“The new regime introduces progressive taxation, where gains are assessed according to the payer’s income band. This is in line with practices in the United States, the United Kingdom, South Africa, Ghana and Brazil,” Oyedele said.

He added that capital gains would now be taxed on a net gains-and-losses basis, while reinvestment relief remains in place.

Exemptions will apply to small companies and individuals with proceeds of up to N150 million or gains not exceeding N10 million. Other reliefs include exemptions for corporate reorganisations and the continuation of the low withholding tax on dividends.

Oyedele further noted that, beyond capital gains, the government is considering broader measures to make Nigeria’s tax environment more attractive for investment. These include reducing Companies Income Tax (CIT) from 30 per cent to 25 per cent, harmonising over 60 separate taxes into fewer than 10, scrapping minimum tax on turnover, and raising the threshold for CGT exemptions on shares.

He added: “We are also exploring exemptions for Real Estate Investment Trusts (REITs) and securities lending, granting VAT credits on assets to reduce investment costs, and providing personal income tax exemptions or final withholding tax on fixed-income securities.”

He stressed that the overall reforms aim to level the playing field, align Nigeria with international best practices, and position the capital market as a driver of economic growth.

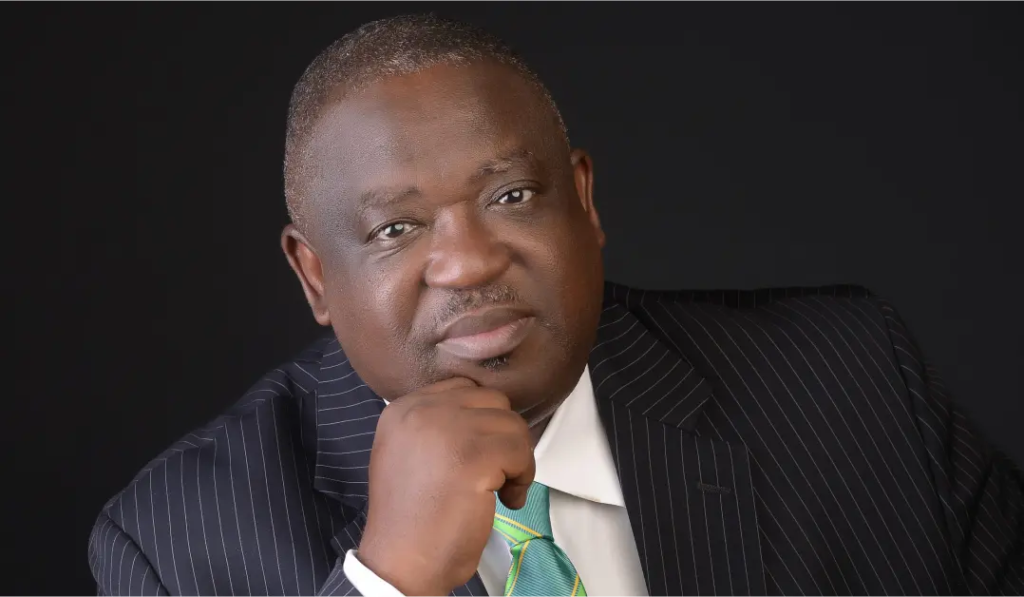

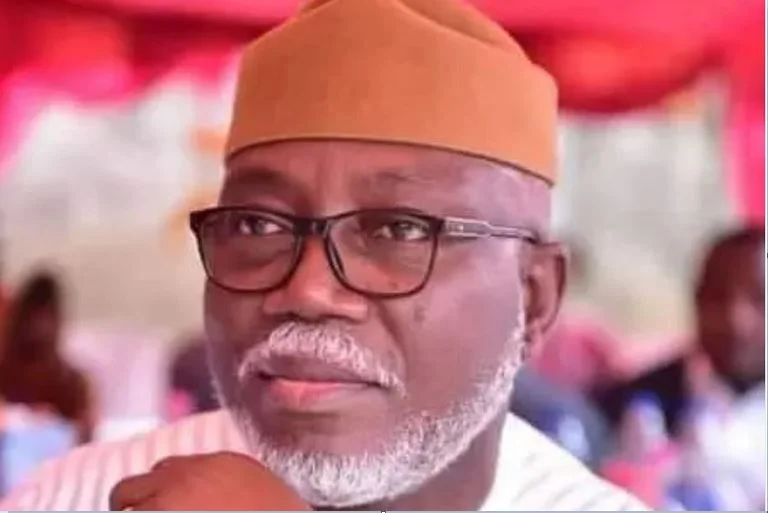

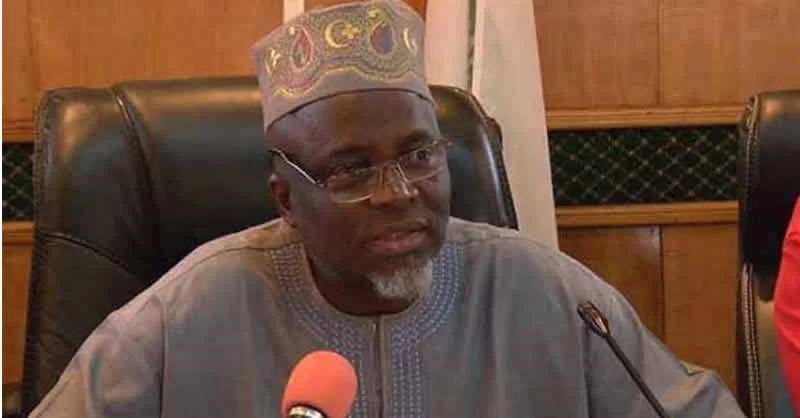

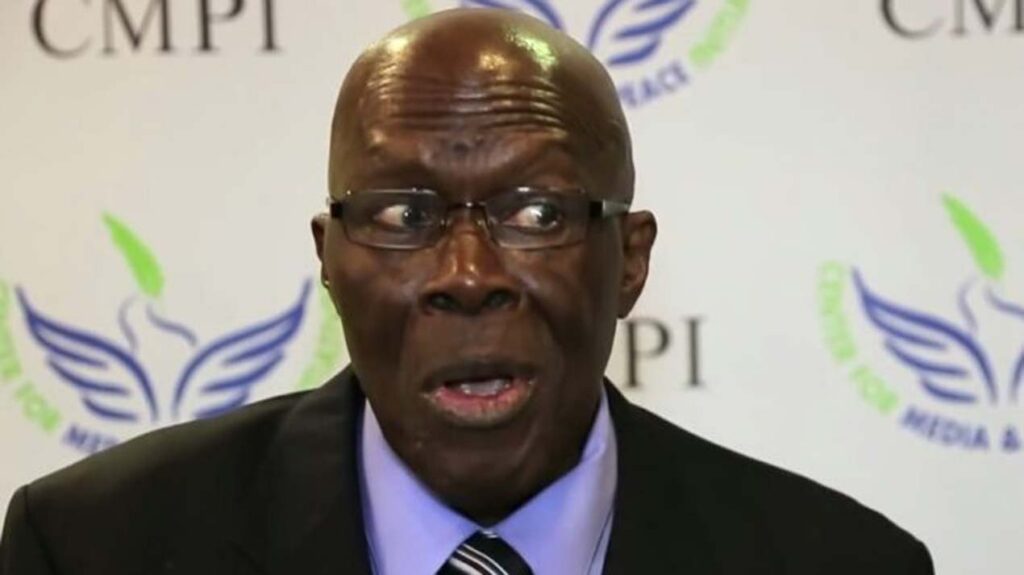

In his remarks, NGX Chairman, Dr Umaru Kwairanga, described the engagement as timely, given the Federal Government’s ongoing overhaul of the tax system.

Kwairanga said the capital gains segment was vital to both individuals and institutions, underscoring the need for stakeholders to understand the changes. He added that the NGX would continue to ensure that stakeholder input is integrated into the reform process.