Nigeria Spends $2.01bn on External Debt Repayment in Four Months

Nigeria increased its external debt repayment by 49 per cent year-on-year, according to recent international payment data from the Central Bank of Nigeria (CBN).

Between January and April 2025, the Federal Government spent $2.01 billion servicing foreign debt, up from $1.33 billion during the same period in 2024.

Debt servicing accounted for 77.1 per cent of Nigeria’s total international payments over the four-month period — a sharp rise from 64.5 per cent recorded in the corresponding period of 2024.

Overall international payments, including debt service, remittances, and letters of credit, stood at $2.60 billion as of April 2025, compared to $2.07 billion the previous year.

The country’s foreign reserves reportedly declined by about $3 billion during the period under review.

Monthly figures show that Nigeria paid $540.67 million in January 2025, slightly down from $560.52 million in January 2024. February payments remained relatively stable at $276.73 million compared to $283.22 million in 2024.

However, debt service surged in March to $632.36 million — more than double the $276.17 million paid in March 2024. In April, another $557.79 million was repaid, representing a 159 per cent rise from the $215.20 million recorded a year earlier.

Together, March and April accounted for nearly $1.2 billion in repayments.

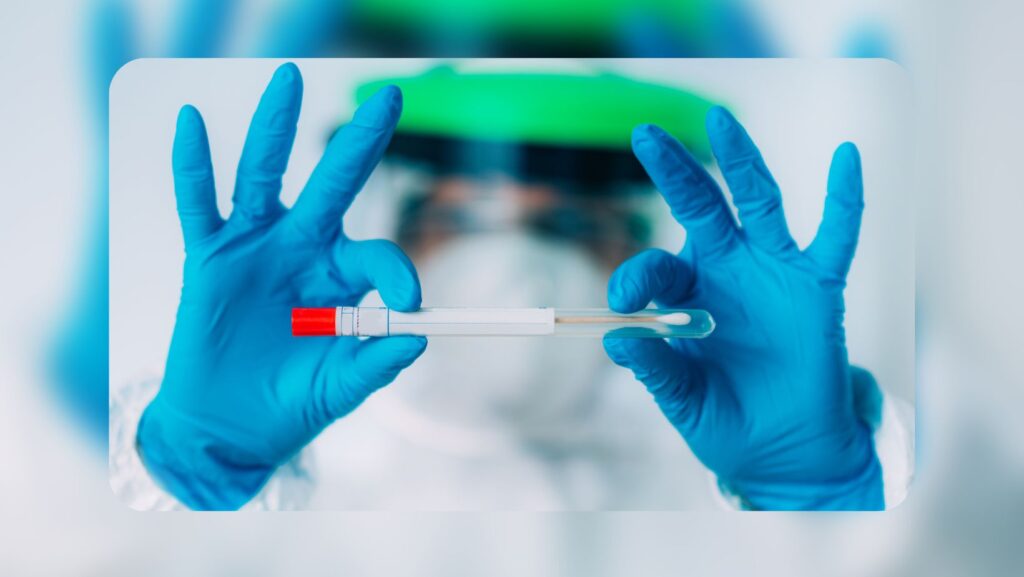

The development follows confirmation from the International Monetary Fund (IMF) that Nigeria has fully repaid the $3.4 billion it received under the Rapid Financing Instrument (RFI) to mitigate the impact of the COVID-19 pandemic.

The loan, disbursed in April 2020, was one of the largest issued under the RFI globally, and came with relatively favourable terms.

A statement on behalf of IMF Resident Representative, Christian Ebeke, noted that: “As of 30 April 2025, Nigeria has fully repaid the $3.4 billion support it received from the IMF under the RFI to cushion the effects of the COVID-19 pandemic and the sharp fall in oil prices.”

Although the principal has been cleared, Nigeria will continue paying annual fees of around $30 million tied to Special Drawing Rights (SDR) charges. These charges apply as long as Nigeria’s SDR holdings (currently at SDR 3,164 million or $4.3 billion) remain below its cumulative allocation of SDR 4,027 million ($5.5 billion).

The fees are based on the SDR interest rate, which is updated weekly.