No More COVID Waivers: CBN Tightens Rules, Demands Capital Recovery Plans

As part of its strategy to stabilise the financial system and phase out COVID-era reliefs, the Central Bank of Nigeria (CBN) has mandated all banks to submit a detailed Capital Restoration Plan within 10 working days after the end of each quarter, starting from 30 June 2025.

According to the CBN, each plan must outline how the bank intends to return to full regulatory compliance. This includes cost optimisation, improving asset quality, executing risk transfers, and adjusting long-term business strategies.

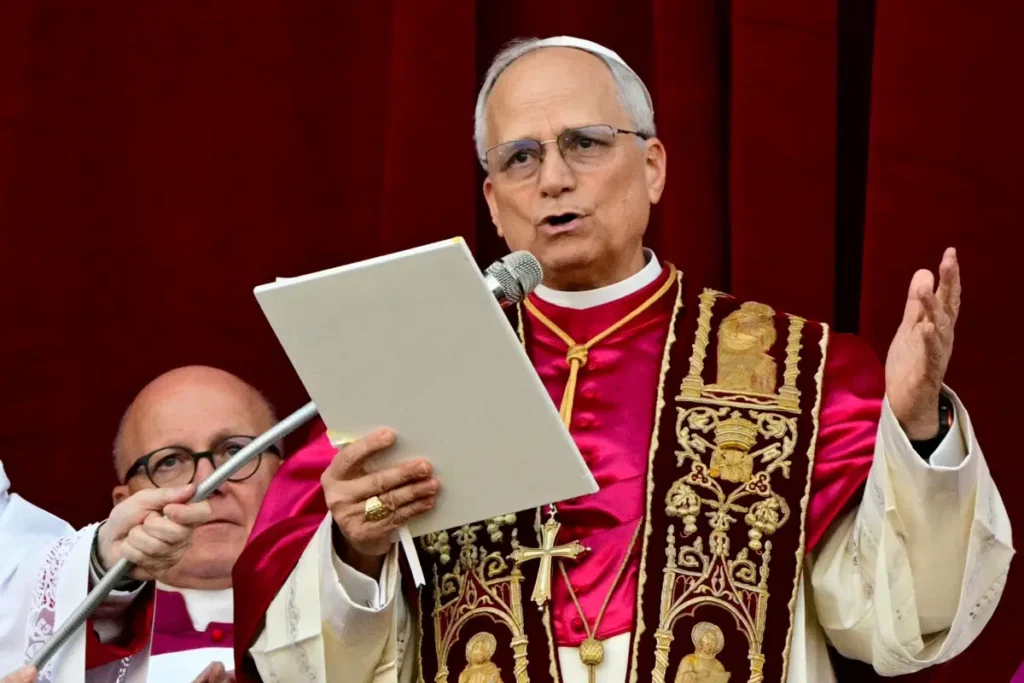

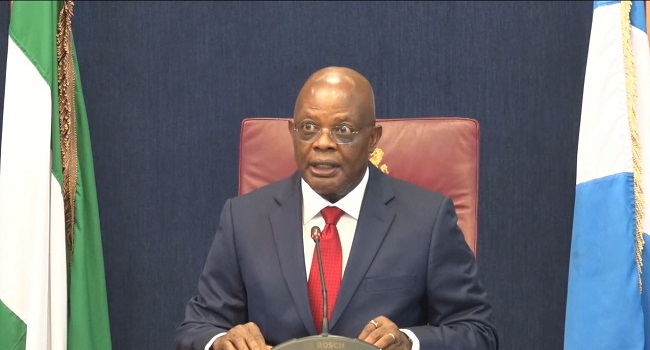

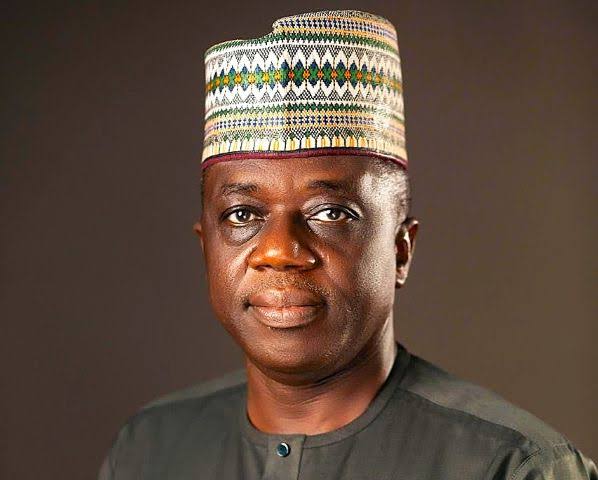

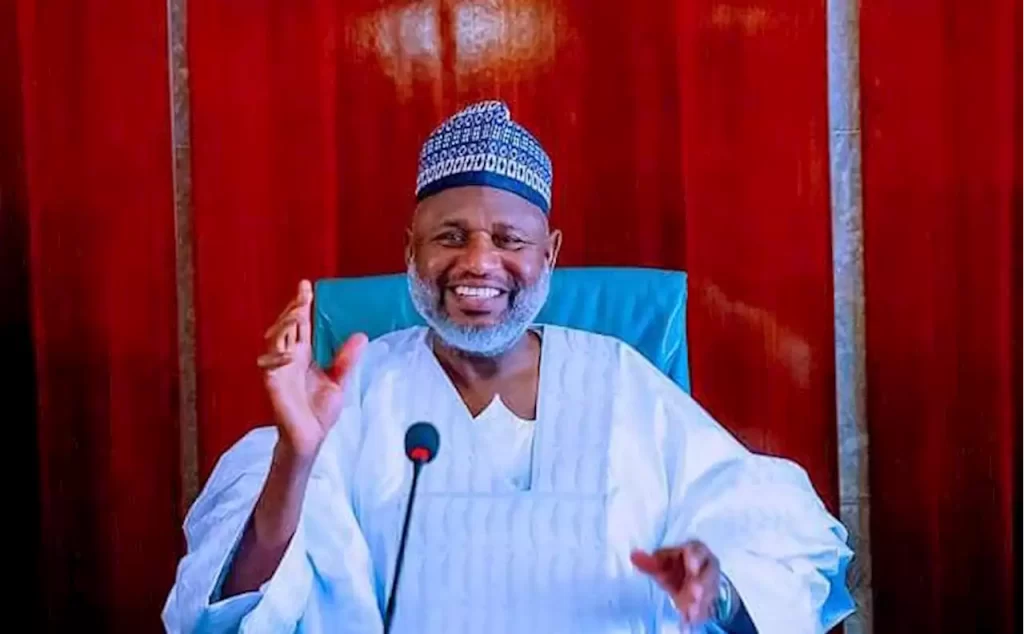

The directive was issued in a circular signed by the Director of Banking Supervision, Dr. Olubukola Akinwunmi, and published on the CBN website on Monday. It forms part of the apex bank’s broader effort to wind down the regulatory forbearance framework introduced during the COVID-19 crisis.

The transitional measures are intended to support affected banks in achieving full prudential compliance while promoting macro-financial stability.

The CBN also announced that all regulatory forbearance and waivers on Single Obligor Limits (SOL) granted during the pandemic will be terminated effective 30 June 2025. This move is aimed at restoring risk sensitivity in credit classification and provisioning.

To accelerate the clean-up of non-performing assets, the CBN has temporarily waived the rule requiring fully provisioned loans to be retained for one year before being written off. This allows banks to reduce their Non-Performing Loan (NPL) ratios more swiftly, provided they meet internal governance requirements.

Additionally, the regulatory caps on Additional Tier 1 (AT1) capital recognition in calculating Capital Adequacy Ratio (CAR) will be lifted from 30 June 2025 to 31 March 2026. However, the CBN clarified that this is not a replacement for the recapitalisation programme announced in March.

“To complement these measures and ensure forward-looking capital planning,” the circular stated, “all affected banks are required to submit comprehensive Capital Restoration Plans no later than the 10th working day after each quarter, starting 30 June 2025.”

The plan must detail strategies for achieving full compliance, including cost-saving initiatives, asset reduction plans, significant risk transfers, and adjustments to the business model. These plans will undergo regulatory review and continuous supervisory oversight.

In line with its updated prudential guidelines, the CBN stressed that all affected banks must:

-

Align impacted credit exposures with existing regulations.

-

Disclose provisioning status and reconciliation of affected loans quarterly.

-

Submit CAR calculations both with and without transitional reliefs.

-

Provide data on restructured or impacted facilities.

-

Disclose details on AT1 instruments, including issuance terms and usage.

To ensure retained earnings are conserved for capital strengthening, the CBN has also suspended dividend payments, bonuses to directors and senior executives, and investments in foreign subsidiaries for banks benefitting from the transitional reliefs. These restrictions will remain in place until banks restore their capital and provisioning levels to full compliance.

The CBN urged banks to maintain close engagement with the Banking Supervision Department throughout the transition and to fully adopt sound risk management practices to restore confidence in the financial system.